MBA in Banking and Finance course is a 2 year PG degree program in the domain of finance which introduces students to the management of banking and insurance sectors. This course is designed by DU-SOL with close consideration of professional demands and skills, and is an affordable management course that can be taken up by a large number of students for a successful banking and insurance career.

Please fill the form with the correct details so that our Senior Education Counselor can sort things for You.

Admission to this online program in Delhi University’s School of Open Learning starts in July. The exact dates for registration & application form filling can be obtained from the official website for each new academic session.

Here are some quick MBA facts about DU-SOL:

Find more details about the MBA program in Banking and Insurance in DU-SOL here:

The full course expense for a very long time is INR 95,000, which incorporates the charges for educational expenses, college improvement reserves, understudy government assistance reserves, SLMs, offices charges and so on. The yearly payable sum is INR 47,500. The college gives a charge reduction of INR 400 to understudies who don't settle on printed SLMs as an eco-accommodating drive. The enlistment expense for the course and the assessment charge (on semester-wise premise) are charged independently.

Read More

Candidates who need to apply to this course should essentially be Single guy's alumni from perceived colleges/organizations of advanced education. They ought to have a base total score of half checks at graduation. Applicants from any flood of schooling are qualified to apply to the course. Working experts searching for a MBA degree close by a task can likewise apply to this course.

Read More

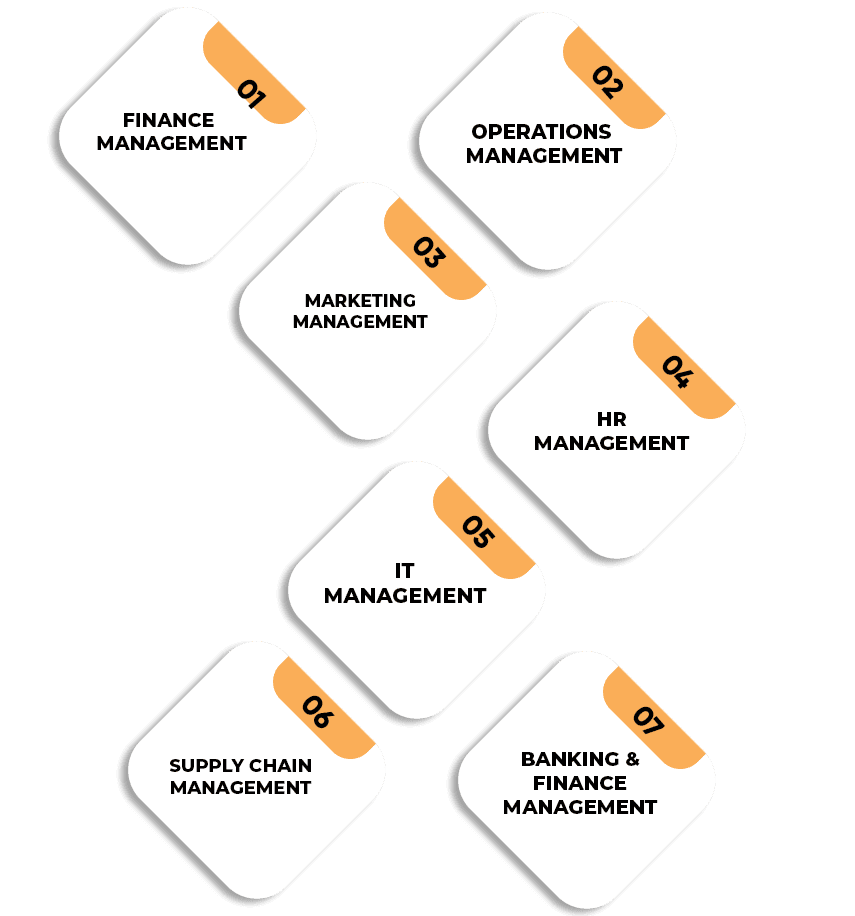

The course prospectus for the MBA in Banking and Protection incorporates various center administration papers presented in the underlying semesters like promoting the executives, essential money the board, human asset the executives and so on and specialisation-explicit courses like credit assessment, checking and recuperation the board, funding, risk the board, retailing and CRM and so on. There are involved preparation and ability advancement accommodated the course during the Individual Contact Projects (PCPs).

Understudies taking affirmation in this course ought to enroll themselves online on the authority college site as new clients. They ought to then fill the application structure with significant subtleties, append the advanced duplicates of their unique records, and pay the enlistment charge to present their application. In the wake of screening the applications, competitors are chosen in view of legitimacy records and entry results (for non-DU graduates). The college likewise leads mop-adjusts and spot-rounds of affirmations relying on seat accessibility.

Read More

Being a postgraduate degree program, this MBA course in Banking and Insurance is of a duration of 2 years. The course is divided into 4 semesters, with a summer break after the completion of the second semester. The maximum duration of the course is 4 years, within which a student must complete all the papers to obtain the degree.

The situation administrations of DU-SOL are agreeably high as the committed arrangement cell of the college sorts out standard industry studios and connections, work fairs, position drives and so forth with top scouts like Genpact, ICICI Bank, Pivot Bank, Wipro and so on. Consequently, with the MBA program in Banking and Protection, moves on from DU-SOL can investigate top open positions in monetary organizations and firms just after course culmination.

English is the language of instruction for programmes. The course is entirely student-driven and concentrates on cutting-edge management educational technology for candidates of the new generation. At DU SOL, a large percentage of the coursework is delivered via online education rather than in-person instruction.

In order to receive their different degrees, the students must pass their first and second year exams. The exams will include assessments such as viva-voce, assignments, projects, and four-semester tests over the full course. The examination accounts for 70% of the final grade, with assignments and other assessment components accounting for the remaining 30%.

The programme lasts two years. A student must complete the programme in two years, however the university offers an upper length limit of an extra two years from the date of registration for the relevant programme if the student needs more time. The course will take 4 years total, or 2 plus 2 years.

Internal assessment is extremely important in management degree programmes, especially for students who struggle to pass % on theory papers alone. The assignments, along with other activities like vivas, case analyses, project work, etc., are some of the most crucial components of internal evaluations. Assignments account for a combined 30% of the weighted grade in each subject. As a result, it is advised to take assignments seriously and be creative.

There are many requirements to meet in order to be admitted to a programme. First of all is getting a graduation degree with at least 50% marks. The student must have passed the mathematics portion of the 10+2 exam. Commerce graduates will be given preference in the admission procedure. After these events, students must participate in group discussions and interviews.